| UK GDP edged up 0.1% in August, supported by stronger manufacturing output and improving private sector confidence | Inflation held steady at 3.8%, fuelling expectations of another potential interest rate cut by year-end | Global equities rose as US tech earnings impressed and a US-China trade truce boosted market optimism |

UK economy returns to growth

Figures published last month by the Office for National Statistics (ONS) showed the UK economy grew slightly in August, while survey data points to a more recent improvement in business conditions.

According to the latest monthly gross domestic product (GDP) statistics, UK output increased by 0.1% in August; this followed a 0.1% contraction in July. August’s principal driver of growth was the manufacturing sector – which expanded by 0.7% – while the larger services sector actually saw no growth at all during the month.

As monthly data can be volatile, ONS is increasingly focusing on growth over a three-month rolling period and, on this measure, the latest figures showed the economy grew by 0.3% in the three months to August. This represents a slight improvement on a growth rate of 0.2% recorded across the previous three-month period.

While the latest GDP figures showed that growth over the summer was relatively modest, new forecasts released last month by the International Monetary Fund (IMF) suggest the UK economy is still likely to outperform most of its peers this year. Indeed, the IMF’s updated projections point to an annual growth rate of 1.3%, which would position the UK as the second-fastest-growing of the world’s most advanced economies in 2025.

The latest evidence from a closely-watched economic survey also provided encouraging news in relation to private sector output, with the preliminary headline growth indicator from the S&P Global UK Purchasing Managers’ Index (PMI) rising to 51.1 in October; this figure was up from 50.1 in September.

Commenting on the findings, S&P Global Market Intelligence’s Chief Business Economist Chris Williamson said October’s data brings hope that “business conditions are starting to improve.” He added, “Output has picked up, with a particularly welcome return to growth for manufacturing, accompanied by an upturn in demand for services, notably among consumers.”

Inflation unexpectedly holds steady

The latest batch of consumer price statistics revealed the UK headline rate of inflation remained stable in September, raising the chances of another interest rate cut within the next few months.

Figures published by ONS showed the Consumer Prices Index (CPI) 12-month rate – which compares prices in the current month with the same period a year earlier – remained unchanged at 3.8% in September. This reading surprised most economists with the consensus view from a Reuters poll predicting the rate would hit 4.0%.

ONS said the largest upward inflation drivers were petrol prices and airfares, while these were offset by lower prices for a range of recreational and cultural purchases including live events. Food and non-alcoholic drinks inflation also eased during September, with prices in this sector actually posting a monthly fall for the first time since May 2024.

Expectations that the Bank of England (BoE) might sanction another reduction in interest rates rose immediately after release of the inflation data. Indeed, markets moved to price in a 75% probability of rates being cut once more by December, a notable jump from a 46% chance before the CPI figure had been released.

Investor expectations, however, did ease back towards the end of last month. The IMF also warned the BoE to be ‘very cautious’ about future rate cuts after publishing its updated economic forecast which predicts the UK will have the highest inflation rate amongst the world’s most advanced economies both this year and next.

A recent Reuters poll also found that a slight majority of economists now expect to see no further rate reductions this year, although a majority are predicting two further cuts by the middle of 2026. The Bank’s interest-rate setting committee has two more meetings scheduled this year, with its next decision due to be announced on 6 November.

Markets

As October drew to a close, tech stocks pushed Wall Street higher as investors embraced strong earnings from some of the ‘Magnificent Seven,’ including Amazon, which helped rekindle optimism for tech mega cap growth.

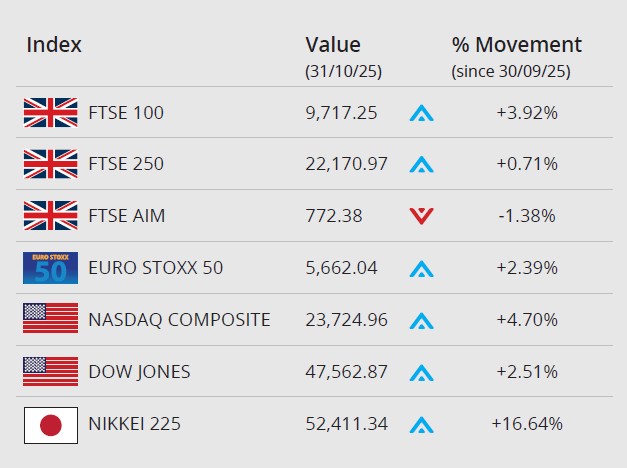

Relief to businesses and consumers came at month end on the news of a one-year trade truce between the US and China, resulting in lower tariffs and export controls. The Dow Jones closed October on 47,562.87, an increase of 2.51% in the month. The tech-focused NASDAQ closed the month up 4.70% on 23,724.96.

In the UK, the FTSE 100 closed October on 9,717.25, a gain of 3.92%. The mid-cap FTSE 250 gained 0.71% in the month to end on 22,170.97, while the FTSE AIM recorded a 1.38% loss to close October on 772.38. On the continent the Euro Stoxx 50 gained 2.39% during the month to close on 5,662.04. In Japan, the Nikkei 225 gained 16.64% to close the month on 52,411.34, reaching record highs towards month end as investors welcomed the truce between Washington and Beijing.

On the foreign exchanges, the euro closed the month at €1.13 against sterling. The US dollar closed at $1.31 against sterling and at $1.15 against the euro.

Brent Crude closed October at around $64 a barrel, recording a loss of 3.57% in the month. The oil price dipped at month end, ahead of an anticipated increase in output by OPEC and its allies (OPEC+). The gold price rose 3.59% during the month, closing at around $4,009 a troy ounce.

Chancellor facing Budget challenge

Pressure on the Chancellor ahead of the Autumn Budget increased last month, following publication of the latest public finance statistics and a potentially larger-than-expected downgrade to productivity forecasts.

Data released by ONS revealed that government borrowing in September totalled £20.2bn; this was £1.6bn more than the same month last year and the highest September figure since 2020. It left cumulative borrowing across the first six months of the financial year £7.2bn above the monthly profile consistent with the latest Office for Budget Responsibility (OBR) forecast produced in March.

The OBR is currently working on an updated forecast to be unveiled alongside the Budget on 26 November, and last month saw intense speculation that a key productivity forecast will be cut by more than previously expected. While accurately estimating the size of the hit from this potential downgrade is difficult, analysts suggest it could put a £20bn hole in the public finances.

Earlier in the month, the Institute for Fiscal Studies (IFS) also said there was a ‘strong case’ for the Chancellor to increase the amount of fiscal headroom she has built into the system. This, the IFS argues, would bring greater stability and avoid the Chancellor ‘limping from one forecast to the next.’

Retail sales grow for fourth month in a row

Last month’s official retail sales data revealed that volumes rose for a fourth consecutive month, while the latest GfK confidence figures suggest consumer sentiment now stands at its joint-highest level in over a year.

ONS statistics showed that total retail sales volumes rose by 0.5% in September, defying analysts’ expectations of a 0.2% monthly fall. This growth was largely driven by sales of new tech gadgets, including Apple’s iPhone 17 and strong demand for gold from online jewellers. Across the third quarter as a whole, the data release reported sales growth of 0.9%, a notable acceleration from 0.2% in the second quarter.

October’s GfK consumer confidence survey also delivered positive news, with its headline index rising to -17 from -19 in September; this metric was last higher in August 2024. GfK said the rise was primarily driven by a four-point jump in the ‘major purchase’ component, which was boosted by an Amazon Prime sales event and competing offers from other retailers.

The data did, however, show that consumers’ views of their own finances in the year ahead worsened, with GfK noting that consumers and retailers will both be closely watching the Budget for any potential impact on spending ahead of the crucial Black Friday weekend sales.

All details are correct at the time of writing (03 November 2025)

It is important to take professional advice before making any decision relating to your personal finances. Information within this document is based on our current understanding and can be subject to change without notice and the accuracy and completeness of the information cannot be guaranteed. It does not provide individual tailored investment advice and is for guidance only. Some rules may vary in different parts of the UK. We cannot assume legal liability for any errors or omissions it might contain. Levels and bases of, and reliefs from, taxation are those currently applying or proposed and are subject to change; their value depends on the individual circumstances of the investor. No part of this document may be reproduced in any manner without prior permission.